Buying a company can be quite a thrilling, nevertheless tough endeavor. It’s like selecting to adopt a fully-grown plant in lieu of developing a person from the seed. There’s quite a bit previously in place, but nurturing it to flourish within your arms necessitates thorough considered. Organization acquisition isn’t almost buying belongings; it’s about taking on an entire ecosystem. From employees to culture to shoppers—every little thing that makes that company tick. It’s No surprise why so many entrepreneurs come across acquisitions an appealing shortcut to growth. But as interesting mainly because it Appears, the method could be fraught with complexities. Enable’s dive into what it genuinely can take to obtain a business.

The 20-Second Trick For Business Acquisition

On the subject of business enterprise acquisition, research is essential. This is when you roll up your sleeves and dig deep. You wouldn’t purchase a house without having inspecting the foundation, proper? Exactly the same theory applies right here. You’ll have to evaluate financials, purchaser bases, contracts, and perhaps the reputation with the organization. The goal would be to uncover any possible red flags before you decide to indication around the dotted line. Think about it like peeling back the levels of an onion—you want to know exactly what you’re stepping into, even when a few tears are drop together the way.

On the subject of business enterprise acquisition, research is essential. This is when you roll up your sleeves and dig deep. You wouldn’t purchase a house without having inspecting the foundation, proper? Exactly the same theory applies right here. You’ll have to evaluate financials, purchaser bases, contracts, and perhaps the reputation with the organization. The goal would be to uncover any possible red flags before you decide to indication around the dotted line. Think about it like peeling back the levels of an onion—you want to know exactly what you’re stepping into, even when a few tears are drop together the way.Amongst the greatest reasons entrepreneurs go after business acquisitions is pace. Developing a firm from scratch usually takes a long time. Buying an current business enterprise helps you to hit the bottom operating, often inheriting a faithful client foundation, established model, and revenue streams. Imagine skipping the awkward early stages of a startup and diving straight into a company with momentum. Though it’s tempting, you’ll continue to should infuse your own private eyesight to stay away from stagnation. This mixture of present construction and new Suggestions can create effective growth alternatives.

Funding a company acquisition is commonly the trickiest Element of the procedure. No matter whether you’re tapping into personal financial savings, searching for buyers, or securing a bank loan, acquiring the funds is vital. But don’t let money stand inside your way. The truth is, there are actually Inventive approaches to framework a deal, like seller financing, in which the seller accepts payments after a while rather then a lump sum upfront. It’s like agreeing to purchase a vehicle in excess of many several years as an alternative to abruptly. The true secret is negotiating terms that function for both get-togethers.

The subsequent stage in a company acquisition is integration. After you’ve bought the business, How will you ensure it is your personal? It’s like going into a new dwelling—you wish to rearrange the furnishings, probably paint a couple of walls, even so the framework stays. Integration involves aligning the present firm’s functions with all your vision. No matter if it’s tweaking procedures, altering management, or maybe rebranding, this phase establishes whether the acquisition gets successful or simply a headache. And don’t forget the individuals aspect—personnel may well experience nervous about new possession. Clear communication along with a sound transition prepare might help simplicity these problems.

Some Known Facts About Business Acquisition.

A person very important factor frequently overlooked all through a company acquisition is culture. Enterprise lifestyle will be the invisible glue that retains anything collectively. It’s the character of your organization, shaped through the those who function there, their values, and just how they do points. Merging two distinct cultures is like mixing oil and h2o if not managed correctly. Will The brand new culture complement or clash with what now exists? It’s necessary to manage a stability involving maintaining critical cultural elements and introducing new values that align with the eyesight.

A person very important factor frequently overlooked all through a company acquisition is culture. Enterprise lifestyle will be the invisible glue that retains anything collectively. It’s the character of your organization, shaped through the those who function there, their values, and just how they do points. Merging two distinct cultures is like mixing oil and h2o if not managed correctly. Will The brand new culture complement or clash with what now exists? It’s necessary to manage a stability involving maintaining critical cultural elements and introducing new values that align with the eyesight.Evaluating the strategic in shape of the acquisition is another critical factor. You must talk to your self, "Does this business enterprise align with my long-phrase aims?" Acquisitions should make sense regarding synergy. Probably the business gives complementary solutions or products and services, or perhaps it opens doors to new markets. Like fitting items of the puzzle jointly, the acquisition should really total a picture that makes sense. If not, you chance investing time and methods into a thing that would not finally benefit your overall technique.

When considering a business acquisition, it’s essential to recognize the hazards. Every single deal has an element of threat—no acquisition is actually a confident issue. Let's say the business’s crucial clientele leave after the acquisition? What if the industry usually takes a nosedive? It’s vital to conduct a possibility assessment just before dealing with Using the offer. Visualize it as weighing the pros and cons of shopping for a utilised automobile. You want to know the opportunity challenges you could possibly confront in the future, whether or not they’re manageable or deal-breakers.

Article-acquisition issues can crop up unexpectedly. Whilst the acquisition system by itself may be sophisticated, the true function normally starts after the ink dries. Guaranteeing a smooth changeover is vital for preventing any disruptions in functions. For example, will there be variations in management? How will you handle the considerations of workforce? Just like a pilot having control of a airplane mid-flight, you should be certain almost everything continues to be regular when steering the company towards new horizons. Missteps at this time could be highly-priced, each fiscally and in terms of dropped rely on.

An additional essential thing to consider in company acquisition is valuation. How would you identify what a business is absolutely truly worth? This isn’t a matter of guessing or wishful pondering—it’s a calculated course of action. You’ll need to look at economic statements, long run earnings opportunity, as well as the intangible assets like brand name price or purchaser loyalty. Visualize trying to cost a unusual vintage car or truck. Guaranteed, the make and product make any difference, but so does the vehicle’s condition, its history, and its uniqueness. Similarly, a thorough valuation procedure guarantees you’re having to pay a fair cost for your enterprise.

All About Business Acquisition

Synergy is one of the most powerful motorists driving productive company acquisitions. When two companies appear collectively, they've the potential to accomplish over the sum of their sections. Synergy can manifest in alternative ways—Price price savings by economies of scale, elevated sector share, or Improved innovation through collaboration. It’s like Placing two puzzle pieces jointly; the put together whole really should provide a little something better than what each bit gives by itself. Figuring out these synergies in the acquisition method can present you with a clear photo of the real price of the deal.Buying a business usually comes along with its share of Opposition. You’re not the only real one scouting for an ideal option. Other purchasers could possibly have their eyes on the same goal, and the method can immediately turn into a bidding war. It’s a good deal like dwelling hunting inside a competitive current market—You could have to act quick or make an offer previously mentioned the inquiring rate to win the deal. But at the same time, you don’t need to overpay. Placing the appropriate equilibrium between eagerness and caution is crucial once you’re competing with other likely prospective buyers.

Sometimes, buying a distressed business enterprise is usually an attractive option. Distressed businesses tend to be obtainable at a lower price, presenting an opportunity to show matters all-around and unlock concealed price. It’s like buying a fixer-upper home; you can spend money on repairs and enhancements, finally reaping the benefits. Nonetheless, there’s also a major possibility concerned. You’ll require To judge whether or not the organization’s difficulties are fixable or in the event you’re stepping into a sinking ship. Being familiar with why the small business is having difficulties is key before you make a dedication.

The function of advisors in business enterprise acquisition can't be overstated. Lawyers, accountants, and business consultants Enjoy a vital part in guaranteeing the process operates easily. These professionals work as your guiding lights, aiding you navigate lawful complexities, tax implications, and fiscal evaluations. Having a stable group of advisors is like aquiring a pit crew for the duration of a race—they maintain you on target and aid stay clear of expensive mistakes. It’s tempting to Consider you can take care of everything yourself, but their experience may make all the difference between a clean acquisition and a rocky a single.

Timing is yet another essential facet of small business acquisition. The right time to accumulate a company relies on numerous variables, together with marketplace situations, your economic readiness, as well as concentrate on organization’s general performance. Timing the acquisition much too early could indicate jumping into something devoid of adequate preparing. On the flip side, waiting way too lengthy may produce skipped chances. It’s like catching a wave even though browsing—You will need to paddle hard at the best moment, otherwise you hazard staying swept absent or lacking the wave completely. Figuring out the appropriate moment to explore more strike could make or split the deal.

Put up-acquisition advancement strategies are exactly where the rubber fulfills the road. Now that you just individual the business enterprise, how do you consider it to the next stage? No matter if by products enlargement, coming into new markets, or buying technology, advancement really should be the main focus once the changeover is comprehensive. This is where your eyesight to the enterprise will come into Enjoy. Consider it like inheriting a back garden. It’s by now blooming, but along with your nurturing contact, it is possible to introduce new bouquets and cultivate an all the more vibrant landscape. Crystal clear, actionable development options are important to maximizing the advantages of the acquisition.

Conversation is crucial for the duration of and once the acquisition procedure. From personnel to customers to shareholders, Every person included really should understand what’s taking place explore more and why. Think about conversation similar to the glue that retains everything together. With out it, even the most effective-laid acquisition strategies can unravel. Open up, transparent communication helps regulate expectations, serene anxieties, and Establish believe in. It’s like navigating a ship by way of stormy seas—holding Everybody knowledgeable and engaged can protect against avoidable panic and ensure the ship stays on track.

The Only Guide for Business Acquisition

Acquisitions even have a significant effect on branding. Based on the corporation you’re obtaining, you may want to consider rebranding or aligning the acquired corporation’s brand with yours. This might contain adjustments in logos, messaging, or maybe company values. Branding is much more than simply a symbol—it’s the essence of what a business stands for. Consider acquiring a restaurant chain; if their model id doesn’t align with your vision, you could possibly really need to apply alterations without the need of alienating loyal clients. Watchful branding selections may also help integrate the new company easily into your current functions.

And lastly, an missed but important aspect of company acquisition may be the emotional toll. Business owners typically undervalue the psychological and emotional strain that includes getting and integrating a business. From negotiations to controlling the transition, the anxiety might be enormous. It’s like working a marathon—you may need stamina, persistence, and dedication to determine it via to the end. But with the right mindset, support, and preparing, the benefits of An effective acquisition can much outweigh the difficulties. The true secret is always see details to keep the eye on the prize

Neve Campbell Then & Now!

Neve Campbell Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Joseph Mazzello Then & Now!

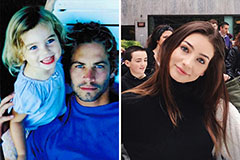

Joseph Mazzello Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!